UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §14a-11(c) or Rule 14a-12

AtriCure, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | | | | |

| | | |

| ☒ | | No fee required. |

| | | |

| ☐ | | Fee paid previously with preliminary materials. |

| | | |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

ATRICURE,ATRICURE, INC.

7555 Innovation Way

Mason, Ohio 45040

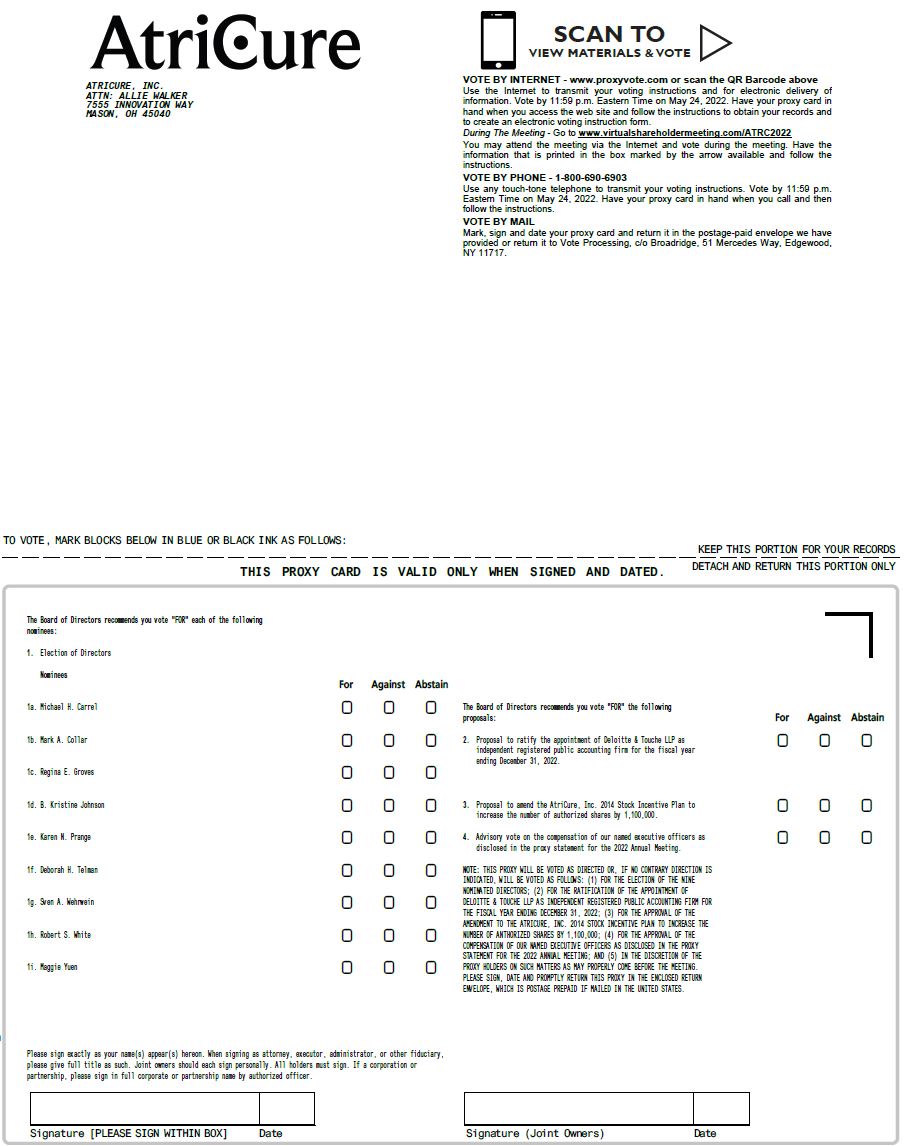

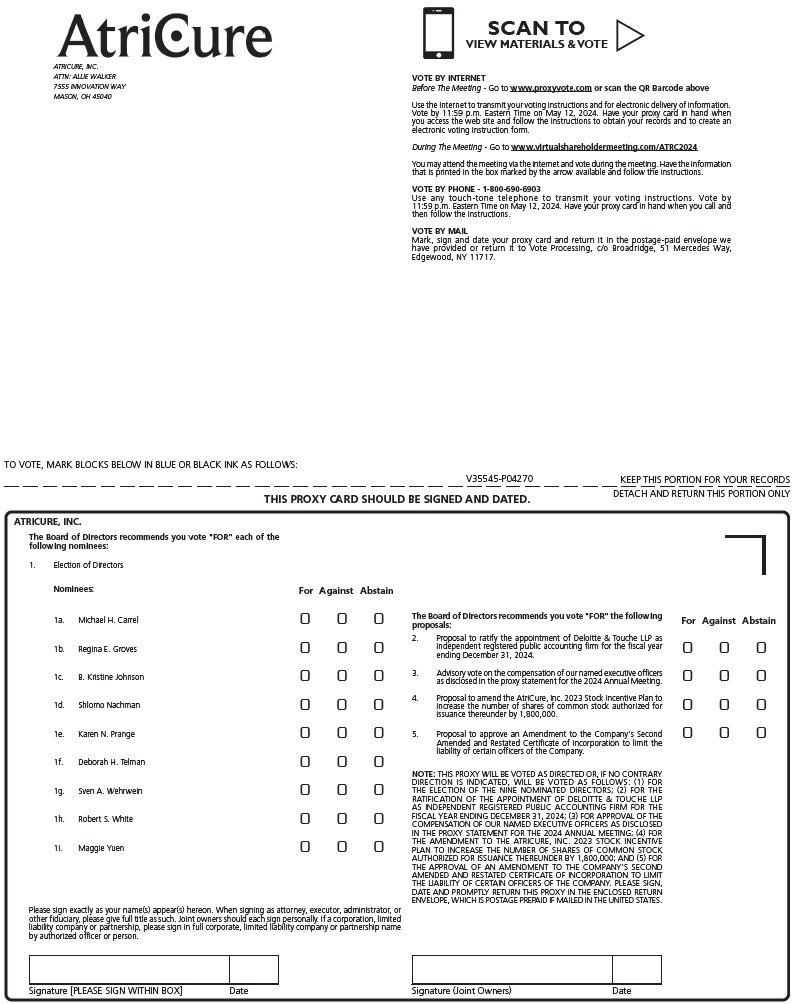

NOTICE OF 20222024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 25, 202213, 2024

To Our Stockholders:

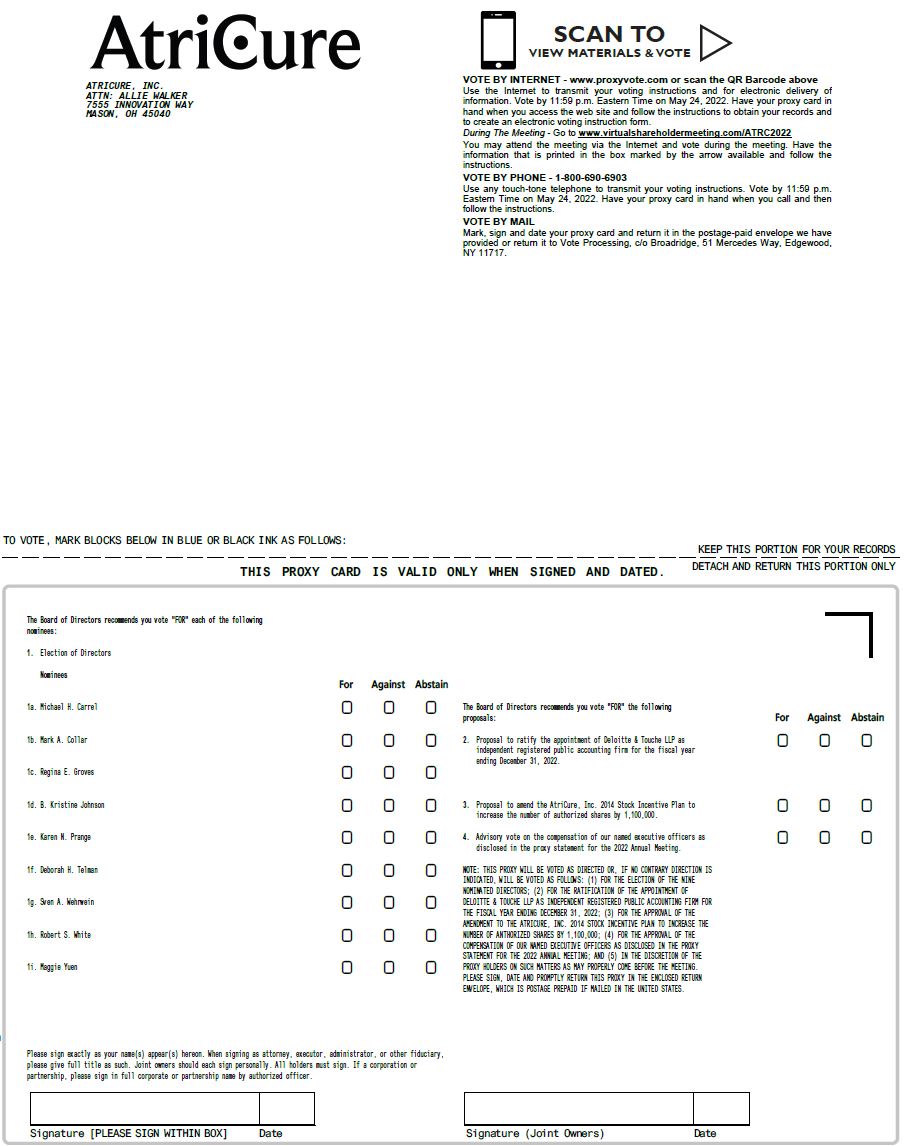

You are cordially invited to attend the 20222024 Annual Meeting of Stockholders (Annual Meeting) of AtriCure, Inc. (the Company or AtriCure) on Wednesday,Monday, May 25, 2022. 13, 2024. This year’s Annual Meeting will be a virtual meeting of stockholders. We believe that hosting a virtual meeting provides expanded access and improved communication between our stockholders and the Company. You will be able to attend the Annual Meeting online, vote your shares electronically, and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/ATRC2022. ATRC2024 and using the control number distributed with these proxy materials. You will not be able to attend the Annual Meeting in person. The meeting will be held for the following purposes, as more fully described in the accompanying proxy statement:

1.To elect nine directors nominated by the Board of Directors, each to serve for a one-year term that expires at the 20232025 Annual Meeting of Stockholders and until their successors have been duly elected and qualified;

2.To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022;2024;

3.To approve an amendment to the AtriCure, Inc. 2014 Stock Incentive Plan to increase the number of shares of common stock authorized for issuance thereunder by 1,100,000;

4.To conduct an advisory vote on the compensation of our named executive officers as disclosed in this proxy statement;

4.To approve an amendment to the AtriCure, Inc. 2023 Stock Incentive Plan to increase the number of shares of common stock authorized for issuance thereunder by 1,800,000;

5.To approve an amendment to AtriCure's Second Amended and Restated Certificate of Incorporation to limit the liability of certain officers of the Company; and

5.6.To transact such other business as may properly come before the Annual Meeting or any continuations, postponements or adjournments.adjournments by or at the discretion of the Board of Directors of the Company.

The Annual Meeting will begin promptly at 9:11:00 a.m. EDT.ET. Only holders of record of shares of AtriCure common stock (Nasdaq:(NASDAQ: ATRC) at the close of business on March 28, 202218, 2024 will be entitled to notice of, and to vote at, the Annual Meeting and any continuations, postponements or adjournments of the Annual Meeting.

Under U.S. Securities and Exchange Commission rules we are furnishing our proxy materials over the Internet and mailing our stockholders a Notice of Internet Availability of Proxy Materials (Notice). The Notice contains instructions on how to access and review our proxy statement and 20212023 Annual Report over the Internet.

A complete list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose in connection with the Annual Meeting during normal business hours at our principal executive offices for a period of at least 10 days prior to the Annual Meeting.

| | | | | |

| By order of the Board of Directors, |

| |

| /s/ Angela L. Wirick |

| Angela L. Wirick |

| Chief Financial Officer |

Mason, Ohio

April 11, 20223, 2024

YOUR VOTE IS IMPORTANT! ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING ONLINE. WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE PROXY CARD, OR VOTE OVER THE TELEPHONE OR INTERNET AS INSTRUCTED IN THESE MATERIALS, AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING. EVEN IF YOU HAVE VOTED BY PROXY, YOU MAY STILL VOTE YOUR SHARES ELECTRONICALLY IF YOU ATTEND THE ANNUAL MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE ANNUAL MEETING, YOU MUST OBTAIN A PROXY ISSUED IN YOUR NAME FROM THAT RECORD HOLDER IN ORDER TO BE ENTITLED TO VOTE ELECTRONICALLY AT THE ANNUAL MEETING.

ATRICURE, INC.

***IMPORTANT NOTICE***

Regarding Internet Availability of Proxy Materials

for the Annual Meeting to be held on May 25, 202213, 2024

You are receiving this communication because you hold shares in AtriCure, Inc, and the materials you should review before you cast your vote are now available.

The notice, proxy statement and Annual Report on Form 10-K are available at:

ir.atricure.com

TABLE OF CONTENTS

ATRICURE, INC.

PROXY STATEMENT

FOR

20222024 ANNUAL MEETING OF STOCKHOLDERS

The Board of Directors of AtriCure, Inc., a Delaware corporation, is soliciting the enclosed proxy from you. The proxy will be used at our 20222024 Annual Meeting of Stockholders to be held on Wednesday,Monday, May 25, 2022,13, 2024, beginning at 9:11:00 a.m. EDT. The Annual Meeting will be held online at www.virtualshareholdermeeting.com/ATRC2022.ATRC2024. This proxy statement contains important information regarding the 20222024 Annual Meeting of Stockholders. Specifically, it identifies the matters upon which you are being asked to vote, provides information that you may find useful in determining how to vote and describes the voting procedures.

In this proxy statement: the terms “we”, “our”, “us”, “AtriCure” and the “Company” each refer to AtriCure, Inc.; the term “Board” means our Board of Directors; the term “proxy materials” means this proxy statement, the enclosed proxy card and our Annual Report on Form 10-K for the year ended December 31, 2021,2023, filed with the U.S. Securities and Exchange Commission (SEC); and the term “meeting” means our 20222024 Annual Meeting of Stockholders, including any continuations, postponements or adjournments thereof.

QUESTIONS AND ANSWERS REGARDING THIS SOLICITATION

AND VOTING AT THE ANNUAL MEETING

Why will I be able to attend the meeting virtually and not in person?

We are hosting a virtual meeting of stockholders because the virtual meeting format provides expanded access and improved communication between our stockholders and the Company. We see the virtual format as a way to drive more stockholders to attend and participate in the Annual Meeting because the virtual format allows stockholders, wherever they may be located, to attend the Annual Meeting. Mindful that our stockholders reside in locations throughout the United States and the world, we want to provide an opportunity to our stockholders to attend the Annual Meeting without incurring the expense or devoting the time to travel to a physical location. In other words, we believe that the virtual format not only enhances the access stockholders have in attending the Annual Meeting, but it also saves our stockholders the money and time travel can require.

We have designed our virtual format to enhance, rather than constrain, stockholdersstockholders' access and participation. For example, if you experience technical difficulties during the Annual Meeting, there will be technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting or voting at the meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be listed on the Annual Meeting login web page.

How can I receive proxy materials?

Under rules adopted by the U.S. Securities and Exchange Commission (SEC), we are furnishing proxy materials to our stockholders primarily via the Internet, instead of mailing printed copies of proxy materials to each stockholder. On or about April 11, 2022,3, 2024, we began mailing to our stockholders a Notice of Internet Availability of Proxy Materials (Notice) containing instructions on how to access this proxy statement, the accompanying notice of annual meeting and our annual report for the fiscal year ended December 31, 20212023 online. If you received the Notice, by mail, you will not automatically receive a printed copy of proxy materials in the mail.materials. Instead, the Notice instructs you on how to access and review all of the important information contained in the proxy materials. The Notice also instructs you on how you may submit your proxy via the Internet.

You can receive a printed copy of our proxy materials by following the instructions contained in the Notice regarding how you may request to receive your materials electronically or in printed form. Requests for printed copies of the proxy materials can be made by Internet at http://www.proxyvote.com, by telephone at 1-800-579-1639 or by email at sendmaterial@proxyvote.com by sending a blank email with your control number in the subject line.

What information is contained in this proxy statement?

The information in this proxy statement relates to the proposals to be voted on at the meeting, the voting process, the compensation of our directors and the most highly paid executive officers during 20212023 and certain other required information.

Who is entitled to vote at the meeting?

Only stockholders who owned our common stock at the close of business on March 28, 202218, 2024 (the Record Date) are entitled to notice of and to vote at the meeting and at any continuations, postponements or adjournments thereof.

Who can attend the meeting?

Stockholders of records as of the Record Date may attend the meeting. If you are not a stockholder of record but hold shares in street name (that is, through a broker or nominee), you will need to provide proof of beneficial ownership as of March 28, 2022,the Record Date, such as your most recent brokerage account statement, a copy of the voting instruction card provided by your broker, trustee or nominee, or other similar evidence of ownership.ownership in order to attend the meeting.

What are my voting rights?

On each matter to be voted upon, you have one vote for each share of common stock you own as of March 28, 2022.18, 2024. You may vote all shares owned by you as of March 28, 2022,18, 2024, including (1) shares held directly in your name as the stockholder of record and (2) shares held for you as the beneficial owner through a broker, trustee or other nominee such as a bank.

| | | | | |

| Items to be voted on at meeting | Board Recommendation |

Item 1: The election of nine nominees to serve as directors on our Board | FOR each nominee |

Item 2: The ratification of the appointment of our independent registered public accounting firm for fiscal year 20222024 | FOR |

Item 3: An advisory vote on the compensation of our named executive officers as disclosed in this proxy statement | FOR |

Item 4: Amending the AtriCure, Inc. 20142023 Stock Incentive Plan to increase the number of shares of common stock authorized for issuance thereunder by 1,100,000 shares1,800,000 | FOR |

Item 4: An advisory vote on5: Approve an amendment to AtriCure's Second Amended and Restated Certificate of Incorporation to limit the compensationliability of our named executivecertain officers as disclosed in this proxy statementof the Company | FOR |

These proposals are described more fully below. As of the date of this proxy statement, this is the only business that our Board intends to present or knows of that others will present at the meeting. If any other matter or matters are properly brought before the meeting, each properly executed proxy card will be voted in the discretion of the proxies named therein.

What constitutes a quorum?

A quorum is required to conduct business at the meeting. The presence at the meeting, virtually or by proxy, of the holders of a majority of the shares of our common stock entitled to vote at the meeting will constitute a quorum. As of March 28, 2022, 46,268,58018, 2024, 48,374,624 shares of our common stock were outstanding. Both abstentions and broker non-votes are counted for the purpose of determining the presence of a quorum.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent directly to you by us. As the stockholder of record, you have the right to grant your voting proxy directly to the persons named as proxy holders or to vote virtually at the meeting. We have enclosed a proxy card for your use.

If your shares are held in a brokerage account or by another nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you together with a voting instruction card. As the beneficial owner, you have the right to direct your broker, trustee or nominee how to vote and are also invited to attend the meeting. Please note that since a beneficial owner is not the stockholder of record, you may not vote these shares virtually at the meeting unless you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, which

gives you the right to vote the shares at the meeting. Your broker, trustee or nominee has enclosed or provided voting instructions for your use in directing the broker, trustee or nominee as to how you would like them to vote your shares.

How can I vote my shares virtually at the meeting?

If you are a registered stockholder, there are several ways for you to vote. You may attend the Annual Meeting via the Internet and vote during the Annual Meeting. You may also vote by Internet before the date of the Annual Meeting, by proxy or by telephone, using one of the methods described in the proxy card. Even if you plan to attend the meeting, we recommend that you also submit your proxy card or voting instructions as described below so that your vote will be counted if you later decide not to, or are unable to, attend the meeting.

Can I vote my shares without attending the meeting?

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the meeting. Stockholders of record may submit proxies by the Internet or telephone by following the instructions in the Notice or by completing, signing and dating their proxy cards and mailing them in the accompanying pre-addressed envelope. Stockholders holding shares beneficially in street nameBeneficial owners may vote by following the instructions provided by the broker, trustee or nominee holding the shares.

What if I want to revoke and change my vote?

You may change your vote at any time prior to the vote at the meeting. If you are the stockholder of record, you may change your votevote: (i) by granting a new proxy bearing a later date or granting a later proxy by telephone or the Internet (which automatically revokes your earlier proxy), (ii) by providing a written notice of revocation to our Secretary prior to your shares being voted or (iii) by attending the meeting and voting virtually. Please note that attending the meeting will not cause your previously granted proxy to be revoked unless you specifically so request. For shares you hold beneficially in street name, you may change your vote by submitting new voting instructions to your broker, trustee or nominee, or, if you have obtained a legal proxy from your broker, trustee or nominee which gives you the right to vote your shares, by attending the meeting and voting virtually.

What vote is required to approve each item and how are votes counted?

The vote required to approve each item of business and the method for counting votes is set forth below:

•Election of Directors. AtriCure has adopted a majority voting standard for director elections which means that, subject to the provisions of Section 3.3 of our Bylaws, in an uncontested election of directors such as this (i.e., an election where the number of nominees does not exceed the number of directors to be elected at the meeting), each director shall be elected by the vote of the majority of the votes cast with respect to that director’s election at any meeting for the election of directors at which a quorum is present. In any election of directors that is not an uncontested election, directors shall be elected by a plurality of the votes cast. A “majority of the votes cast” means that the number of shares voted “for” a director must exceed the number of votes cast “against” that director’s election. “Abstentions” and “broker non-votes” shall not be counted as votes cast with respect to a director’s election. You may vote “FOR”, “AGAINST” or "ABSTAIN" with respect to any or all of the director nominees or “WITHHOLD” your vote for any or all director nominees. A properly executed proxy marked “WITHHOLD” with respect toAbstentions and broker non-votes will have no effect on the election of one or more director nominees will not be voted with respect to the director or directors indicated.directors.

•Ratification of Independent Registered Public Accounting Firm. For the approval of the ratification of the independent registered public accounting firm, the affirmative “FOR” vote of a majority of the voting power of the shares represented virtually or by proxy and entitled to vote thereon will be required. You may vote “FOR”, “AGAINST” or “ABSTAIN” for this item of business. If you “ABSTAIN”, your abstention has the same effect as a vote “AGAINST”. Broker non-votes will have no effect on the approval of this item of business.

•Advisory Vote on Compensation of Named Executive Officers. For the approval, on an advisory basis, of the compensation of our named executive officers, the affirmative “FOR” vote of a majority of the voting power of the shares represented virtually or by proxy and entitled to vote thereon will be required. You may vote “FOR”, “AGAINST” or “ABSTAIN” for this item of business. If you “ABSTAIN”, your abstention has the same effect as a vote “AGAINST”. Broker non-votes will have no effect on the approval of this item of business.

•Approval of Amendment to the AtriCure, Inc. 20142023 Stock Incentive Plan. For the amendment toof the AtriCure, Inc. 20142023 Stock Incentive Plan, the affirmative “FOR” vote of a majority of the voting power of the shares represented virtually or by proxy and entitled to vote thereon will be required. You may vote “FOR”, “AGAINST” or “ABSTAIN” for this item of business. If you "ABSTAIN”, your abstention has the same effect as a vote “AGAINST”. Broker non-votes will have no effect on the approval of this item of business.

•Advisory Vote on Compensation

•Approval of Amendment to AtriCure's Second Amended and Restated Certificate of Incorporation. For the approval, on an advisory basis,amendment to our Amended and Restated Certificate of the compensation of our named executive officers,Incorporation, the affirmative “FOR” vote of a majorityat least 66⅔% of the shares represented virtually or by proxy and entitled to voteoutstanding on the record date will be required. You may vote “FOR”, “AGAINST” or “ABSTAIN” for this item of business. If you “ABSTAIN”, your abstention has the same effect as a vote “AGAINST”. Broker non-votes will have the effect as votes "AGAINST".

If you provide specific instructions with regard to certain items, your shares will be voted as you instruct on such items. If you sign your proxy card or voting instruction card without giving specific instructions, your shares will be voted in accordance with the recommendations of the Board (“FOR” all of the nominees to the Board, “FOR” ratification of the

independent registered public accounting firm, "FOR" the amendment to the AtriCure, Inc. 2014 Stock Incentive Plan, “FOR” the approval of the compensation of our named executive officers, "FOR" the amendment of the AtriCure, Inc. 2023 Stock Incentive Plan, "FOR" the amendment to AtriCure's Second Amended and Restated Certificate of Incorporation and in the discretion of the proxy holders on any other matters that properly come before the meeting).

What is a “broker non-vote”?

Under the rules that govern brokers who have record ownership ofown shares that are held in street name for their clients who are the beneficial owners of the shares, brokers have the discretion to vote suchuninstructed shares on routine matters. The ratification of the appointment of an independent public accounting firm (Proposal 2) is considered a routine matter. Your broker, therefore, may vote your shares in its discretion on this routine matter if you do not instruct your broker how to vote on them. If a matter is not considered routine, then your broker is prohibited from voting your shares on the matter unless you have given voting instructions on that matter to your broker.

Because Proposal 1 (election of directors), Proposal 3 (amendment to the AtriCure, Inc. 2014 Stock Incentive Plan) and Proposal 4 (advisory vote on compensation of named executive officers), Proposal 4 (amendment to the AtriCure, Inc. 2023 Stock Incentive Plan) and Proposal 5 (amendment to AtriCure, Inc.'s Amended and Restated Certificate of Incorporation) are not considered routine, brokers holding shares for their customers will not have the ability to cast votes with respect to Proposals 1, 3, 4 and 45 unless they have received instructions from their customers. It is important, therefore, that you provide instructions to your broker if your shares are held by a broker so that your votes with respect to Proposals 1, 3, 4 and 45 are counted. Your broker, therefore, will need to return a proxy card without voting on Proposals 1, 3, 4 and 45 if you do not give voting instructions with respect to these matters. This is referred to as a “broker non-vote”.

How are “broker non-votes” counted?

Broker non-votes will be counted for the purpose of determining the presence of a quorum for the transaction of business but theyand will not be counted in tabulatinghave the voting result for any particular proposal.effects described above.

How are abstentions counted?

If you return a proxy card that indicates an abstention from voting, the shares represented will be counted for the purpose of determining both the presence of a quorum and the total number of shares represented and entitled to vote with respect to a proposal (other than with respect to the election of directors), but they will not be voted on any matter at the meeting. Accordingly, abstentionsproposal. Abstentions will have the same effect as a vote “AGAINST” for Proposals 2, 3, 4 and 4.5, but will have no effect on the election of directors.

What happens if additional matters are presented at the meeting?

Other than the fourfive proposals described in this proxy statement, we are not aware of any other business to be acted upon at the meeting. If you grant a proxy, the persons named as proxy holders, Michael H. Carrel (our President and Chief Executive Officer) and Angela L. Wirick (our Chief Financial Officer), will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If, for any unforeseen reason, any of our nominees are not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by our Board.

Who will serve as inspector of election?

The Secretary of the Company will tabulate the votes and act as inspector of election at the meeting.

What should I do in the event that I receive more than one set of proxy/voting materials?

You may receive more than one set of these proxy materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For instance, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. In addition, if you are a stockholder of record and your shares are registered in more than one name, you may receive more than one proxy

card. Please complete, sign, date and return each proxy card and voting instruction card that you receive to ensure that all of your shares are voted.

Who is soliciting my vote, and who will bear the costs of this solicitation?

Your vote is being solicited on behalf of the Board, and the Company will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement. In addition to these mailed proxy materials, our directors and employees may also solicit proxies virtually, by telephone, by e-mail or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. We may

also engage the services ofhave engaged Alliance Advisors LLC, a professional proxy solicitation firm, to aid in the solicitation of proxies from certain brokers, bank nominees and other institutional owners. Our costsowners for such services, if retained,a fee of $15,000 plus expenses for these services. We also agreed to indemnify Alliance against liabilities and expenses arising in connection with the proxy solicitation unless caused by Alliance's intentional misconduct. We understand that approximately two or three employees of Alliance will not be material.provide these services.

Where can I find the voting results of the meeting?

We intend to announce preliminary voting results at the meeting and publish final results in a Current Report on Form 8-K to be filed with the United States Securities and Exchange Commission within four business days after the meeting.

What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?

As a stockholder, you may be entitled to present proposals for action at a future meeting of stockholders, including director nominations.

•Stockholder Proposals: For a stockholder proposalproposals to be consideredsubmitted for inclusion in our proxy statement forconsideration at the annual meeting to be held in 2023 (20232025 (2025 Annual Meeting), the written proposalnotice that complies with the requirements of our Bylaws must be received by the Secretary of AtriCure at our principal executive offices no earlier than November 12, 20224, 2024 and no later than December 12, 2022. However, if the date of our 2023 Annual Meeting changes by more than 30 days from the date of the meeting, then your notice must be received no later than the close of business on the later of (i) the 150th day prior to the date of the 2023 Annual Meeting or (ii) the 10th day following the date we make a public announcement of the date of the 2023 Annual Meeting.4, 2024. Any notices delivered outside of these dates shall be considered untimely. SuchFor stockholder proposals to be considered for inclusion in our proxy statement for the 2025 Annual Meeting, a proponent stockholder must provide the informationnotice as required by our Bylaws and also must comply with the requirements of Regulation 14A of the Securities Exchange Act of 1934 and any other applicable rules established by the SEC. Proposals should be addressed to cfo@atricure.com or:to:

AtriCure, Inc.

Attn: Secretary

7555 Innovation Way

Mason, Ohio 45040

•Nomination of Director Candidates: You may propose director candidates for consideration by our Board. Any such recommendations should include the nominee’s name and qualifications for Board membership and should be directed to our Secretary at the address set forth above. In addition, our Bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director at an annual meeting, the stockholder must provide the information required by our Bylaws, as well as a statement by the nominee consenting to being named as a nominee and to serve as a director if elected. In addition, the stockholder must give timely notice to our Secretary in accordance with the provisions of our Bylaws, which require that the notice be received by our Secretary no earlier than November 12, 20224, 2024 and no later than December 12, 2022.4, 2024. In order to comply with the universal proxy rules, stockholders who intend to solicit proxies for the 2025 Annual Meeting in support of director nominees other than AtriCure's nominees must also provide notice to AtriCure that sets forth the information required by Exchange Act Rule 14a-19 not later than December 4, 2024.

•Copy of Bylaw Provisions: You may contact our Secretary at our principal executive offices for a copy of the relevant Bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates. Our Bylaws also are filed as an exhibit to our Annual Report on Form 10-K filed with sec.gov.

PROPOSAL ONE—ELECTION OF DIRECTORS

The Board of Directors

Our Amended and Restated Certificate of Incorporation provides that each director shall be elected at each annual meeting of stockholders for a term of one year. Our Amended and Restated Certificate of Incorporation also provides that our Board of Directors may elect directors to fill vacancies or newly created directorships from time to time. Our Board currently consists of the following tennine directors: Michael H. Carrel, Mark A. Collar, Daniel P. Florin, Regina E. Groves, B. Kristine Johnson, Shlomo Nachman, Karen N. Prange, Deborah H. Telman, Sven A. Wehrwein, Robert S. White and Maggie Yuen, each of whose terms expire at this meeting.

Daniel P. Florin, an existing member of the Board, is not a nominee for re-election at the 2022 Annual Meeting. We wish to thank Mr. Florin for his service and important contributions during his tenure.

Director Nominees

The Nominating and Corporate Governance Committee recommended, and the Board nominated, the following people, all of whom are current directors, for re-election as directors: Michael H. Carrel, Mark A. Collar, Regina E. Groves, B. Kristine Johnson, Shlomo Nachman, Karen N. Prange, Deborah H. Telman, Sven A. Wehrwein, Robert S. White and Maggie Yuen. If elected, these nominees will hold office as directors until our 20232025 Annual Meeting and until their respective successors are elected and qualified or until their earlier death, resignation or removal.

| | | Committee Membership |

| | | | Committee Membership(1) | | | | | | Committee Membership(1) |

| Name | Name | Age | Director Since | Independent | Audit | Compensation | Compliance, Quality, and Risk | Nominating and Corporate Governance | Strategy | Name | Age | Director Since | Independent | Audit | Compensation | Compliance, Quality, and Risk | Nominating and Corporate Governance | Strategy |

| Michael H. Carrel | Michael H. Carrel | 51 | 2012 | No | |

| Mark A. Collar | 69 | 2008 | Yes | | X | | C | |

| Regina E. Groves | |

| Regina E. Groves | |

| Regina E. Groves | Regina E. Groves | 63 | 2017 | Yes | X* | | C | | X | 65 | 2017 | Yes | X* | | C | | X |

| B. Kristine Johnson | B. Kristine Johnson | 70 | 2017 | Yes | | X | | X | B. Kristine Johnson | 72 | 2017 | Yes | | X | | | X |

| Shlomo Nachman | | Shlomo Nachman | 62 | 2024 | Yes | | | X | | X |

| Karen N. Prange | Karen N. Prange | 58 | 2019 | Yes | | C | | X | |

| Deborah H. Telman | Deborah H. Telman | 57 | 2021 | Yes | | X+ | |

| Deborah H. Telman | |

| Deborah H. Telman | |

| Sven A. Wehrwein | |

| Sven A. Wehrwein | |

| Sven A. Wehrwein | Sven A. Wehrwein | 71 | 2016 | Yes | C* | | X | |

| Robert S. White | Robert S. White | 60 | 2013 | Yes | | X | X | C |

| Robert S. White | |

| Robert S. White | | 62 | 2013 | Yes | | | X | C |

| Maggie Yuen | Maggie Yuen | 50 | 2021 | Yes | X*+ | |

C = Chair

* = Board designated "audit committee financial expert" under SEC rules.

+ =(1)As reported in Form 8-K/A Amendment No. 1 filed on February 27, 2024, AtriCure reported that effective February 22, 2024, the Board elected Mr. Nachman to serve as a member of each of the Board's Strategy Committee and the Compliance, Quality and Risk Committee. Mr. Nachman was elected to the Board effective January 4, 2024. Effective June 15, 2021,as of the date of the Annual Meeting: (i) Mr. White shall replace Ms. Johnson as Chair of the Board; (ii) Ms. Telman joinedwill replace Mr. White as Chair of the Nominating and Corporate Governance Committee,Committee; (iii) Ms. Johnson shall replace Mr. White as Chair of the Strategy Committee; and Ms. Yuen joined(iv) Mr. White shall no longer be a member of the AuditCompliance, Quality and Risk Committee.

Biographical Information of Directors and Director Nominees

Biographical information about each of our directors and director nominees is set forth below. Information is provided as of the Record Date of March 28, 2022.18, 2024. The primary experience, qualifications, attributes and skills of each director nominee that led to the conclusion that such nominee should serve as a member of the Board of Directors are also described below.

Michael H. Carrel. Mr. Carrel has been President, Chief Executive Officer and director since November 2012. Since joining AtriCure, Mr. Carrel has fostered a patient-first company mission by focusing on the three core areas: innovation, clinical science and education. This strategic approach has led AtriCure to significantly invest in the development of a pipeline of novel products and groundbreaking clinical trials for the treatment of atrial fibrillation (Afib), left atrial appendage management and pain management;management, and continue to expand its market presence within Europeglobally. These investments have driven significant growth in AtriCure's revenue from $82 million in 2013 to $399 million in 2023 and Asia;allowed us to help over 100,000 patients worldwide in 2023 and grow the global employee baseone million to date. Further, market cap has increased from 200$115 million to over 900 employees.approximately $1.7 billion at December 31, 2023 under his leadership. In addition, during Mike’sMr. Carrel's tenure, AtriCure has acquired three companies, Estech, nContact, and SentreHEART, adding leading ablation and appendage management technologies to further AtriCure’s market position worldwide.

His career includes successful leadership in global organizations in healthcare and technology industries. Before joining AtriCure, Mr. Carrel was President and Chief Executive Officer of Vital Images, Inc., a publicly-traded medical

imaging software company. Under his leadership, the company grew revenue and profitability, increased global market share, expanded its presence to over 90 countries andwhich was successfully sold toacquired by Toshiba Medical Systems Corporation. Prior to Vital Images, Mr. Carrel was President and CEO of Zamba Corporation, a publicly-traded technology company, and Chief Financial Officer of NextNet Wireless, Inc., a privately-held provider of non-line-of-sight plug and play broadband wireless access systems.which also had successful acquisition exits.

Mr. Carrel is Board Chair of Axonics, Inc., a publicly traded company and heglobal leader in medical devices for incontinence therapies that recently announced an agreement to be acquired by Boston Scientific. Mr. Carrel has served on the Board of Axonics since 2019. Mr. Carrel is also the Vice Board Chair of Big Brothers Big Sisters of America and has served on the Board since 2021, and he has served on the Board of Medical Device Manufacturers Association (MDMA) since 2017. Mr. Carrel holds a B.S. in Accounting from Pennsylvania State University and an M.B.A. from The Wharton School at the University of Pennsylvania.

Mr. Carrel’sCarrel has significant experience in positions advising and overseeing strategic development and management of rapid growth. His extensive understanding of our business, operations and strategy, as well as the medical device industry experienceand competitive landscape qualify him to serve on our Board of Directors.

Mark A. Collar. Mr. Collar has served as one of our directors since February 2008. Mr. Collar is the owner of Collar, Ltd., an investment and consulting business. Mr. Collar retired in 2008 as an officer within the Procter and Gamble Company where his roles included President of the Global Pharmaceuticals and Personal Health business. Mr. Collar joined Procter and Gamble in 1975 as a sales representative, then moved into advertising, and subsequently assumed roles of progressive responsibility within the Health and Personal Care, Beauty Care, New Business Development, Pharmaceuticals and Personal Health Care Products divisions over his 32-year career. Mr. Collar previously served as a director of First Financial Bancorp; Enable Injections, Inc., a privately-held start-up company focusing on high volume injection devices for biologic drugs; and as Board Chairman at TTRC, LLC (Invisible Ink Tattoo Removers), a national tattoo removal chain from 2014 to 2019. Mr. Collar also serves in director and advisory roles in several philanthropic, academic and economic development organizations. Mr. Collar received his B.S. from Northern Illinois University.

Mr. Collar brings a wealth of knowledge from his 32 years at Procter and Gamble, including marketing, competitive analysis, operations, mergers and acquisitions, financial management, sales corporate strategy, risk management, regulatory and quality control. Mr. Collar’s leadership roles in a number of organizations, including his prior membership on the board of another publicly traded company, provide us with insights into a number of opportunistic fields as well as dealing with government officials and agencies, executive compensation and corporate governance matters.

Regina E. Groves. Ms. Groves has served as one of our directors since March 2017. Ms. Groves currently serves as a director for two privatelymember of the Board of Directors of Fulgent Genetics, Inc., a publicly traded company providing technology-based therapeutic development and clinical diagnostics and three privately-held life science companies. Most recently, Ms. Groves held medical device companies, Advanced NanoTherapies, Inc. andmultiple leadership roles at Stimwave, LLC. Ms. Groves joined Stimwave’s Board of Directors inserved as a director from July 2019 and wasto December 2022, the Chief Financial Officer from September 2019 to December 2020 and Chief Operating Officer from SeptemberNovember 2019 to December 2020. From September 2015 to March 2019,Before her roles at Stimwave, LLC, Ms. Groves wasserved as the Chief Executive Officer at REVA Medical, Inc., from 2015 to 2019, a formerly publicly-traded medical device company focused on the development and commercialization of bioresorbable polymer technologies for vascular applications. Prior to joining REVA Medical, Ms. Groves served asshe held multiple positions at Medtronic, Inc a leading global medical technology company from 2002 to 2015. As Vice President and General Manager of AF Solutions, Cardiac Rhythm and Heart Failure division, of Medtronic, Inc., a leading global medical technology company. In this position, she successfully developed and executed strategies to re-enter the catheter-based Afib ablation market and achieved the goal to be market leader in paroxysmal, or intermittent, Afib ablation. Additionally, Ms. Groves successfully acquired and integrated companies, completed numerous clinical trials and launched novel products in the United States and worldwide. Prior to this, she was the Vice President of Quality and Regulatory for Medtronic’s Cardiac Rhythm Disease Management (CRDM) business from 2006 to 2008 and before that was Vice President and General Manager for Patient Management CRDM at Medtronic from 2002 to 2006. Ms. Groves holds a B.S. in Pharmacy from the University of Florida and an M.B.A. from Harvard Graduate School of Business Administration.

As a seasoned executive in the medical device industry, Ms. Groves has significant leadership experience and diverse business skill set with a global perspective. Her background includes management of rapid growth, financial turnaround, acquisition integration and significant and complex events with reputational impact (including FDA). She is an expert in enterprise risk assessment and mitigation and possesses functional experience in strategy, finance, sales, Afib, manufacturing operations and marketing matters which the Board considers as valuable skills for evaluating and improving the Company’s competitive position as well as supporting the functions of the Board’s various committees. Ms. Groves holds a CERT Certificate in Cybersecurity Oversight and qualifies as an “audit committee financial expert” under SEC rules.

B. Kristine Johnson. Ms. Johnson has served as one of our directors since March 2017. Ms. Johnson iswas most recently President and aManaging General Partner of Affinity Capital Management, a venture capital firm that investshas invested primarily in seed and early-stage health care companies in the United States, since 2000.from 2000 to 2023. Prior to joining Affinity Capital Management, Ms. Johnson was Chief Administrative Officer of Medtronic, Inc. During her seventeen years at Medtronic, she also served as President and General Manager of its vascularVascular business and President and General Manager of its tachyarrhythmia managementTachyarrhythmia Management business. She currently serves as a director for two other publicly traded med-tech companies: ClearPoint Neuro, Inc., formerly MRI Interventions, ViewRay, Inc. and Paragon28, Inc. She also servespreviously served as a director and Chair of the board chair ofBoard for the University of Minnesota Foundation Investment Advisors. She previously

served asAdvisors and lead director on the Board of Directors of Piper Jaffray (now Piper Sandler), a publicly-held middle market investment bank and asset management firm. Her previous public board experience also includes service on the Boards of Directors of ViewRay, Inc.; Spectranetics, Inc., which was acquired by Royal Philips;; ADC Telecommunications, Inc. which was acquired by Tyco Electronics; and Pentair, Inc. In 2018, Ms. Johnson was a National Association of Corporate Directors (NACD) Directorship 100 Honoree. Ms. Johnson received her B.A. from St. Olaf College.

Ms. Johnson has extensive experience in both the health care industry and the venture capital business, with the medical device industry being one of the primary areas of focus. Her deep ties to the health care and venture capital industries, as well as the significant experience she has from other public company boards, provide the Board with valuable insights and knowledge, particularly in matters related to mergers and acquisitions, executive compensation, corporate governance and financial reporting.medical technology.

Shlomo Nachman. Mr. Nachman has served as one of our directors since January 2024. Mr. Nachman has held multiple senior operating roles at Johnson & Johnson, and was most recently the Company Group Chairman of Cardiovascular and Specialty Solutions and Vision Groups within Johnson & Johnson's Medical Devices business from 2013 through 2023. He was a member of the Johnson & Johnson Medical Devices Group Operating Committee and led a diverse portfolio of six medical device businesses, including Electrophysiology; Neurovascular Intervention; Ear, Nose & Throat; Breast Aesthetics; Optometry and Ophthalmology. Prior to that, Mr. Nachman served in various roles with increased scope and responsibilities, including Worldwide President of Biosense Webster and Cordis. Mr. Nachman is currently on the board of several private medical device companies, as well as the Arnold and Mable Beckman Foundation, a foundation focused on supporting research in chemistry and life sciences. Mr. Nachman received his Bachelor's Degree in Management and Economics from Technion - Israel Institute of Technology.

Mr. Nachman has over 25 years of experience in the medical device industry and deep knowledge of many related business aspects including research and development, operations, and reinventing commercial models. This experience in operational roles, including strategic planning and market development, are beneficial to the management team and the Board.

Karen N. Prange. Ms. Prange has served as one of our directors since December 2019. Ms. Prange is an Industrial Advisor at EQT Group, a global investment organization, and currently serves on the boards of Nevro Corp. and Embecta Corp., publicly-traded medical device and technology companies and WSAudiology, a privately-owned manufacturer of hearing aids. Ms. Prange was most recently Executive Vice President and Chief Executive Officer for the Global Animal Health, Medical and Dental Surgical Group at Henry Schein, Inc. and a member of theits Executive Committee.Committee from 2016 to 2018. In this role, she led a business that generated over $6 billion of revenue across three different business units, growing the business to above-market levels in all business segments. Prior to her role at Henry Schein, she led thewas Senior Vice President of Boston Scientific and President of its Urology and Pelvic Health business for Boston Scientific, Inc. and served as General Manager of the Micrus Endovascular and Codman Neurovascular business at Johnson & Johnson Company. Ms. Prange serves on the boards of Nevro Corp., WSAudiology and ViewRay, Inc. and is a strategic advisor of Nuvo Group Ltd. She previously served as on the Board of Directors of ViewRay, Inc. and Cantel Medical Corp. which was acquired by Steris Corp. Ms. Prange earned her B.S. in Business Administration with honors from the University of Florida and has completed executive education coursework at UCLA Anderson School of Business and Smith College.

Ms. Prange’s otherPrange has public medical device board service and her extensiveleadership experience in commercial and operational roles in healthcare companies, includingcompanies. Ms. Prange's experience in managing innovation pipelines and acquiring and integrating companies, as well as extensive global business, strategic and innovation, risk management, ESG and regulatory compliance, are beneficial to the management team and the Board.

Deborah H. Telman. Ms. Telman has served as one of our directors since June 2021. Ms. Telman has spent over 20 years in senior executive roles at global companies. She is Executive Vice President, Corporate Affairs and General Counsel for Gilead Sciences, Inc., a leading biopharmaceutical company. Ms. Telman is responsible for Gilead’s legal and corporate affairs function, which includes government and policy, and public affairs, and she additionally serves as the Corporate Secretary of Gilead. Prior to Gilead, Ms. Telman was Executive Vice President and General Counsel for Organon & Co., a global healthcare company formed in March 2021 through a spin off from Merck to focus on improving the health of women throughout their lives. Ms. Telman helped lead the separation work that created a standalone company serving more than 140 markets with more than 60 medicines and products across a range of therapeutic areas. She has responsibility for the company's global legal affairs, compliance and environmental, health and safety. Before Organon, Ms. Telman was General Counsel at Sorrento Therapeutics from 2018 to 2020, where she was responsible for mergers and acquisitions, licensing, governance, finance, human resources, regulatory compliance and legal functions. Previously, she spent four years at Johnson Controls International plc as Vice President and General Counsel - Building Solutions, North America, and prior to that she held executive roles at Abbott Laboratories and The Boeing Company, and was a partner at Winston and Strawn LLP. Ms. Telman received her B.A. in Mathematics from the University of Pennsylvania and J.D. from Boston University School of Law.

Ms. Telman's extensive experience in legal affairs, mergers, acquisitions and divestitures, environmental, health and safety, human capital management, regulatory and compliance and governance roles within healthcare companies are beneficial to the management team and the Board.

Sven A. Wehrwein. Mr. Wehrwein has served as one of our directors since November 2016. Mr. Wehrwein has been an independent financial consultant to emerging companies since 1999. During his 35-plus yearsWith more than three decades in accounting and finance, Mr. Wehrwein has experience as a certified public accountant (inactive), investment banker to emerging-growth companies, chief financial officer and audit committee and board chair. Mr. Wehrwein currently serves as a member of the Board of Directors of Proto Labs, Inc., a custom prototype manufacturer and SPS Commerce, Inc., a supply-chain management software company, both of which are publicly-traded companies. Mr. Wehrwein has also previously served on the boards of directors for a number of other medical device and high growth companies including tenures on the boards of Cogentix Medical, Inc., Compellent Technologies, Inc., Synovis Life Technologies, Inc., and Vital Images and Nonin Medical, Inc.Images. Mr. Wehrwein holds a B.S. in Business from Loyola University of Chicago and an M.S. in Management from the Sloan School, MIT.

Given his experiences in investment banking and in financial leadership positions, Mr. Wehrwein’s qualifications to serve on our Board of Directors include, among other skills and qualifications, his capabilities in financial understanding, strategic planning, corporate governance, mergers and acquisitions, and auditing expertise given his experiences in investment banking and in financial leadership positions.qualify him to serve on our Board of Directors. As Chair of the Audit Committee, Mr. Wehrwein also keeps the board abreastBoard informed of current audit issues and collaborates with our independent auditors and senior management team. Mr. Wehrwein qualifies as an “audit committee financial expert” under SEC rules.

Robert S. White. Mr. White has served as one of our directors since March 2013. Mr. White is an Operating Partner of EW Healthcare Partners since May 2019. Most recently,2018. Previously, Mr. White served as President and Chief Executive Officer of Entellus Medical, Inc., a publicly-traded company that delivered innovative, high quality, minimally-invasive therapeutic solutions to healthcare providers and their patients who suffer from sinusitis. Entellus was acquired by Stryker Corporation in February 2018. Prior to joining Entellus, Mr. White served as President and CEO of TYRX, a privately-held company acquired by Medtronic, Inc. TYRX commercialized innovative, implantable combination drug and device products focused on infection control. Prior to joining TYRX, Mr. White held several senior leadership positions with Medtronic, Inc., including President of Medtronic Kyphon following its $3.9 billion acquisition of the spinal treatment business; President of Physio Control; and was responsible for commercial operations of the Cardiac Rhythm Disease Management business as Vice President of U.S. Sales and Global Marketing. Earlier in his career, Mr. White held positions with General Electric Company and Eli Lilly and Company, among others. Mr. White currently serves on the Board of Directors of TissueTech,BioTissue Holdings Inc., a privately held parentprivately-held company, of Bio-Tissue, Inc. and Amniox Medical, Inc., thatwhich pioneered the development and clinical application of human birth tissue-based products. Mr. White also currently serves on the Board of Directors of Vital Connect, a privately-held company that develops and markets wearable biosensor technology for wireless patient monitoring, and Cardiac Dimensions, a privately-held company that develops and markets treatment modalities to address heart failure and related cardiovascular conditions.conditions, and Melodi Health, a privately-held company focused on infection control. Mr. White has served on the Board of Directors of multiple bio-medical/medical device companies, including Cardiva Medical (acquired by Haemonetics Corp. in February 2021), HyperBranch Medical Technology (acquired by Stryker Corporation in October 2018) and, Novadaq (acquired by Stryker Corporation in June 2018), and Entellus Medical (acquired by Stryker Corporation in December 2017). Mr. White holds a B.S. in Aerospace Engineering from the University of Missouri-Rolla and an M.B.A. from Cornell University.

Mr. White’s significant knowledge of the medical device industry, business development initiatives, regulatory compliance, corporate governance and experience in growing companies and significant mergers and acquisitions experience uniquely benefit AtriCure.

Maggie Yuen. Ms. Yuen has served as one of our directors since June 2021. Ms. Yuen has served as Chief Financial Officer at Penumbra, Inc., a global healthcare company focused on innovative therapies, since December 2019 and is a seasoned executive with more than 20 years of experience within the manufacturing, medical devices and life science industries. Over the course of her career, she has developed financial and operational expertise at both multi-billion dollarmultibillion-dollar public companies and entrepreneurial start-up ventures. Prior to her service with Penumbra, she was Vice President of Finance and Divisional Chief Financial Officer for the Genetic Science Division for Thermo Fisher Scientific Inc. from 2016 to 2019 and was Chief Financial Officer at Mirion Technologies from 2014 to 2016. She has also held various roles at Boston Scientific, GLU Mobile, Lifescan Inc., Picker International, Rockwell Automation and Eaton Corporation. Ms. Yuen received her B.A.Sc. in Accounting, MastersMaster of Accountancy and MBA from Case Western Reserve University.

Ms. Yuen's significant experience in finance, manufacturing and the medical devicesdevice industry benefit AtriCure's Board and management. Ms. Yuen's experience qualifies her as an “audit committee financial expert” under SEC rules.

Board of Directors’ Recommendation

THE BOARD RECOMMENDS THAT YOU VOTE FOR EACH OF THE NOMINEES FOR DIRECTOR LISTED ABOVE.

CORPORATE GOVERNANCE AND BOARD MATTERS

Board Leadership Structure

The Company has separate Chief Executive Officer and Board Chair positions. Ms. Johnson serves as our Board Chair, presiding over Board meetings and providing the Company with the benefit of her appreciation for and understanding of the risks associated with the Company's business, as well as an intimate knowledge of the Company’s technologies and the medical device industry. Mr. Carrel serves as our President and Chief Executive Officer and provides the Company with the benefit of his strategic and creative vision, an extensive knowledge of the Company’s operations, an understanding of the day-to-day challenges faced by companies in the medical device industry and his business and financial know-how. Effective as of the date of the Annual Meeting Mr. White shall replace Ms. Johnson as Chair of the Board.

The Board currently believes that, at this time, based on the skills and responsibilities of the various members of the Board and management, and in light of the general economic, business and competitive environment facing the Company, the separation of the Chair and Chief Executive Officer roles enhances appropriate oversight of management by the Board, Board independence, the accountability to our stockholders by the Board and our overall leadership structure. Furthermore, the Board believes that maintaining separation of the Chair function from that of the Chief Executive Officer allows the Chief Executive Officer to properly focus on managing the business, rather than requiring a significant portion of his efforts to be spent on also overseeing Board matters.

Board Refreshment and Diversity

The Nominating and Corporate Governance Committee continues to consider the views of institutional investors and proxy advisory firms as it evaluates the composition of the Board. When Mr. Carrel joined the Company as Chief Executive Officer in 2012, the Company began examining board membership. A formal refreshment initiative began in 2016, recognizing that six members had served on the Board for ten or more years. The Nominating and Corporate Governance Committee continues to use the Board and Committee evaluation processes to address the Board refreshment initiative and considers diversity a priority. In June 2021, we expandedThe National Association of Corporate Directors (NACD) recognized us as the sizewinner of the Board to ten members with2022 Diversity, Equity & Inclusion Award in the appointmentsSmall Cap - Public Company category. This award recognizes boards that have improved their governance and created long-term value for stakeholders by implementing forward-thinking diversity, equity, and inclusion (DE&I) practices. We believe that the diversity of Deborah H. Telman and Maggie Yuen to theour Board of Directors. As Mr. Florin is not a nomineeDirectors helps to set the “tone at the top” for reelection, we plan for the Board size to be reduced to nine directors after the Annual Meeting.our DE&I initiatives.

Consideration of Director Nominees

Stockholder Nominations and Recommendations. As described above in the Question and Answer section under “What is the deadline to propose actions for consideration at next year’s meeting of stockholders or to nominate individuals to serve as directors?” our Bylaws set forth the procedure for the proper submission of stockholder nominations for membership on our Board. In addition, the Nominating and Corporate Governance Committee may consider properly submitted stockholder recommendations (as opposed to formal nominations) for candidates for membership on the Board. A stockholder may make such a recommendation by submitting the information required by our Bylaws and the following information to our Secretary at 7555 Innovation Way, Mason, Ohio 45040: the candidate’s name, age, home and business contact information, principal occupation or employment, the class and number of shares of AtriCure stock beneficially owned, information regarding any relationships, arrangements or understandings between the candidate and AtriCure and any other information relating to the candidate that is required to be disclosed in the solicitation of proxies for election of directors or is otherwise required, including the candidate’s written consent to being named in the proxy statement, if any, as a nominee and to serving as a director if elected.

Director Qualifications. Members of our Board should have the highest professional and personal ethics and values and conduct themselves consistent with our Code of Conduct. In accordance with our Corporate Governance Guidelines, the Nominating and Corporate Governance Committee formally reviews each director’s continuation on the Board at the expiration of the director’s term. The Board also has set an age limit of 75 for directors, provided that directors turning 75 shall be permitted to serve the remainder of their term. The Board, through recommendation by the Nominating and Corporate Governance Committee or otherwise, may waive the application of this age limit on a case by case basis. The Committee believes that candidates and nominees must reflect a Board that is comprised of directors who (i) are predominantly independent, (ii) are of high integrity, (iii) have qualifications that will increase overall Board effectiveness and (iv) meet other requirements as may be required by applicable rules, such as financial literacy or financial expertise with respect to audit committee members.

Identifying and Evaluating Director Nominees. New candidates for nomination may come to the attention of our Board through professional search firms, stockholders, existing directors, our executive officers or other persons. The Nominating and Corporate Governance Committee will carefully review the qualifications of any candidates who have been properly brought to its attention. Such review may, in the Committee’s discretion, include a review solely of information provided to the Committee or may also include discussions with persons familiar with the candidate, an

interview with the candidate or other actions that the Committee deems proper. The Committee will consider the suitability of each candidate, including the current members of our Board, in light of the current size and composition of the Board. In evaluating the qualifications of the candidates, the Committee considers many factors including issues of character, judgment, independence, age, expertise, diversity of experience, length of service, other commitments and the like. The Committee evaluates such factors, among others, and does not assign any particular weighting or priority to any of these factors nor does the Committee have a formal policy with respect to diversity. Candidates properly recommended by stockholders are evaluated by the independent directors using the same criteria as other candidates.

Director Diversity, Skills and Qualifications

The Board has been focused on attaining a high level of gender diversity. As of the date of this proxy statement, 50%56% of the Company's Board of Directors were women. In addition, the Company meets Nasdaq'sNASDAQ's board diversity objectives.

| Board Diversity Matrix as of December 31, 2021 | | Board Diversity Matrix as of May 13, 2024 | | Board Diversity Matrix as of May 13, 2024 |

| Board Size: | Board Size: | |

| Total Number of Directors | Total Number of Directors | 10 | |

| Total Number of Directors | |

| Total Number of Directors | |

| Gender: | |

| Gender: | |

| Gender: | Gender: | Male | Female | Non-Binary | Gender Undisclosed | Male | Female | Non-Binary | Gender Undisclosed |

| Number of directors based on gender identity | Number of directors based on gender identity | 5 | — | Number of directors based on gender identity | 4 | 5 | — |

| Number of directors who identify in any of the categories below: | Number of directors who identify in any of the categories below: | |

| African American or Black | |

| African American or Black | |

| African American or Black | African American or Black | — | 1 | — | — | 1 | — |

| Alaskan Native or American Indian | Alaskan Native or American Indian | — | Alaskan Native or American Indian | — |

| Asian | Asian | — | 1 | — | Asian | — | 1 | — |

| Hispanic or Latinx | Hispanic or Latinx | — | Hispanic or Latinx | — |

| Native Hawaiian or Pacific Islander | Native Hawaiian or Pacific Islander | — | Native Hawaiian or Pacific Islander | — |

| White | White | 5 | 3 | — | White | 4 | 3 | — |

| Two or More Races or Ethnicities | Two or More Races or Ethnicities | — | Two or More Races or Ethnicities | — |

| LGBTQ+ | LGBTQ+ | — | LGBTQ+ | — |

| Undisclosed | Undisclosed | — | Undisclosed | — |

The following is a summary of relevant skills and qualifications of our existing directors.

| | | | | | | | |

| Diverse Range of Qualifications and Skills Represented by Our Nominees |

| Mergers & Acquisitions | Atrial Fibrillation | Sales & Marketing |

| Service on Public Boards | Strategy | CEO Experience |

| Finance & SOX Compliance | FDA | Risk Management |

| Medical Payment & Reimbursement | Growth Companies & Investment | Medical Devices |

| Corporate Governance | Human Capital Management | Business ContinuityCybersecurity Oversight |

Independence of the Board

The Nasdaq StockNASDAQ Global Market (Nasdaq)(NASDAQ) listing standards require that a majority of the members of a listed company’s board of directors qualify as “independent”, as affirmatively determined by the board of directors. Currently, our Board consists of the following tennine directors: Michael H. Carrel, Mark A. Collar, Daniel P. Florin, Regina E. Groves, B. Kristine Johnson (Chair), Shlomo Nachman, Karen N. Prange, Deborah H. Telman, Sven A. Wehrwein, Robert S. White and Maggie Yuen. Our Board has affirmatively determined that each of the directors and nominees, other than Michael H. Carrel, our President and Chief Executive Officer, is independent under the listing standards established by Nasdaq.NASDAQ.

As required under the NasdaqNASDAQ listing standards, our non-management directors meet in regularly scheduled executive sessions at which only independent directors are present.

Committees of the Board

Our Board has five standing committees: the Audit Committee; the Compensation Committee; the Compliance, Quality and Risk Committee; the Nominating and Corporate Governance Committee; and the Strategy Committee. Each committee has a written charter which is available on our website at ir.atricure.com under “Corporate Governance”. From time to time, our Board may also appoint committees for special purposes.

The following table lists the number of times each committee met in 2021,2023, the major responsibilities, and the current membership for each committee. The table on page 6 and the notes thereto describe changes in membership and chair positions effective as of the date of the Annual Meeting. | | | | | | | | |

Committee / Meetings | Current Committee Members | Key Responsibilities |

Audit 5 meetings | Daniel P. Florin

Regina E. Groves Sven A. Wehrwein (chair) Maggie Yuen | •Responsible for the appointment, compensation, retention and oversight of our independent registered public accounting firm; reviews the scope, fees and results of activities related to audit and non-audit services. •Oversees our financial controls, annual audit and financial reporting. •Reviews the effectiveness of our internal control over financial reporting and accounting and reporting practices and procedures with our management and our independent registered public accountants. •Reviews with management and the independent auditor any significant risks or exposures related to accounting, audit and financial matters, including cybersecurity risk with respect to such matters, and assess the steps management has taken to minimize such risks. |

| | | |

Compensation Committee 65 meetings

| Mark A. Collar

B. Kristine Johnson Karen N. Prange (chair) Deborah H. Telman | •Assists the Board in overseeing the Company’s management compensation policies and practices. •Determines and approves the compensation of our Chief Executive Officer. •Reviews and approves compensation levels for our other executive officers, management incentive compensation policies and programs, equity compensation programs for employees and exercises discretion in the administration of those programs. •Reviews with management our disclosures under “Compensation Discussion and Analysis”, or CD&A, and produces an annual report on executive compensation that contains a recommendation with respect to inclusion of the CD&A in our filings with the SEC. •Recommends the amounts and form of compensation for non-management directors for their service on the Board and committees. |

| | |

| | | | | | | | |

Committee / Meetings | Current Committee Members | Key Responsibilities |

Compliance, Quality & Risk Committee 45 meetings

| Daniel P. Florin

Regina E. Groves (chair) Shlomo Nachman Sven A. Wehrwein Robert S. White | •Responsible for providing ongoing oversight over our Code of Conduct, compliance with applicable U.S. Food and Drug Administration and international requirements and other compliance activities which present significant regulatory risk to us. •Assists the Board in evaluating the effectiveness of our compliance program. •Oversees the Company’s quality systems and compliance, legal and enterprise risk management and control activities. •Oversees compliance with data security and privacy laws, including matters related to data protection and patient and consumer privacy. •Receives reports from management regarding the Company's information security programs, any upgrades necessary, and/or deficiencies identified. |

| | | |

| | | | | | | | |

Nominating and Corporate Governance Committee 45 meetings

| Mark A. Collar (chair)

Karen N. Prange Deborah H. Telman Robert S. White (chair) | •Responsible for reviewing and making recommendations on the composition of our Board and selection of directors. •Periodically assesses the functioning of our Board and its committees and makes recommendations to our Board regarding corporate governance matters and best practices. •Periodically reviews the environmental and social responsibility policies and practices and reporting of the topics. •Responsible for ensuring there is an effective succession plan for the Company’s CEO, which addresses a short-term or unexpected loss of our CEO. •Annually discusses long-term executive succession. |

| | | |

Strategy Committee No4 meetings

| Regina E. Groves B. Kristine Johnson Shlomo Nachman Robert S. White (chair) | •Responsible for assisting the Board in carrying out its oversight responsibilities, from time to time as needed, relating to potential mergers, acquisitions, divestitures, joint ventures and other key strategic transactions outside the ordinary course of the Company’s business, in each case other than any transaction involving a sale or change of control of the Company. |

| | | |

The composition of the Compensation; Compliance, Quality and Risk; Nominating and Governance; and Strategy Committees satisfies the independence requirements of Nasdaq.NASDAQ. Our Board has determined that each member of the Audit Committee meets the independence and financial literacy requirements of the NasdaqNASDAQ rules and the independence requirements of the SEC. Our Board has also determined that Daniel P. Florin, Regina E. Groves, Sven A. Wehrwein, and Maggie Yuen each qualify as an “audit committee financial expert”, as defined in SEC rules.

Our directors are strongly encouraged to attend the Company’s annual meeting of stockholders. All of our directors which served during 2023 attended the 20212023 Annual Meeting. All of our directors attended at least 75% of the aggregate of all Board meetings and meetings of Committees on which such directors served during 2021.2023.

Director Compensation

The Compensation Committee engages an independent compensation consultant to conduct a competitive pay assessment with respect to the compensation of the Company’s non-employee directors every two to three years. Each non-employee director receives retainers for service as follows:

| | Director Compensation | Director Compensation | |

| Annual Cash Retainer | |

| Annual Cash Retainer | |

| Annual Cash Retainer | Annual Cash Retainer | | $ | 50,000 | |

| Additional Cash Retainer to Chair of the Board | Additional Cash Retainer to Chair of the Board | | 50,000 | |

Annual Stock Retainer(1) | Annual Stock Retainer(1) | | 125,000 | |

| | | |

| Committee | |

| Committee | |

| Committee | Committee | Chair Retainer(2) | | Membership Retainer | | Chair Retainer(2) | | Membership Retainer |

| Audit | Audit | $ | 20,000 | | | $ | 10,000 | |

| Compensation | Compensation | 15,000 | | | 7,500 | |

| Compliance, Quality and Risk | Compliance, Quality and Risk | 15,000 | | | 7,500 | |

| Nominating and Corporate Governance | Nominating and Corporate Governance | 10,000 | | | 5,000 | |

| Strategy | Strategy | 10,000 | | | 7,500 | |

(1)Reflects restricted stock granted on the date of the annual meeting of stockholders, with the number of shares determined by dividing the annual retainer by closing stock price on the annual meeting date. The annual grant vests in full on the one-year anniversary of the grant date. Beginning in 2022,2024, the annual stock retainer will increaseincreased to $150,000.$175,000.

(2)Includes committee membership retainer.

Upon appointment to the Board, non-employee directors are granted approximately $175,000 of restricted stock, valued on the date of grant and vesting annually over a three-year period.

Tableperiod in lieu of Contentsthe annual stock retainer. All Board members elected at a subsequent annual meeting of stockholders are granted the Annual Stock Retainer.Director Compensation Table

The following table summarizes compensation earned by our non-employee directors for the year ended December 31, 2021.2023.

| | Name | Name | | Fees Earned or

Paid in Cash ($) | | Stock Awards ($)(1) | | Total ($) | Name | | Fees Earned or

Paid in Cash ($) | | Stock Awards ($)(1) | | Total ($) |

| Mark A. Collar | | $ | 67,500 | | | $ | 124,949 | | | $ | 192,449 | |

| Daniel P. Florin | | 67,500 | | | 124,949 | | | 192,449 | |

| Regina E. Groves | Regina E. Groves | | 80,973 | | | 124,949 | | | 205,922 | |

| B. Kristine Johnson | B. Kristine Johnson | | 98,653 | | | 124,949 | | | 223,602 | |

Shlomo Nachman(2) | |

| Karen N. Prange | Karen N. Prange | | 67,116 | | | 124,949 | | | 192,065 | |

| Deborah H. Telman | Deborah H. Telman | | 29,918 | | | 174,953 | | | 204,871 | |

| Sven A. Wehrwein | Sven A. Wehrwein | | 77,500 | | | 124,949 | | | 202,449 | |

| Robert S. White | Robert S. White | | 72,500 | | | 124,949 | | | 197,449 | |

| Maggie Yuen | Maggie Yuen | | 32,638 | | | 174,953 | | | 207,591 | |

(1)Amounts in the stock awards column represent the aggregate grant date fair value of restricted stock awards computed, as of each award date, in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 718, “Compensation—Stock Compensation” (ASC 718). No stock options were granted during 2021.2023.

(2)Elected to Board effective January 4, 2024.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines to promote the effective functioning of the Board and its Committees, to promote the interests of stockholders and to create a common set of expectations as to how the Board, its Committees, individual directors and management should perform their respective functions. The Board believes that ethics and integrity cannot be legislated or mandated by directive or policy and that the ethics, character, integrity and values of our directors and management remain a critical safeguard in quality corporate governance. The Corporate Governance Guidelines establish the practices the Board will follow with respect to, among other practices, board composition and selection of board nominees, director responsibilities, chief executive officer evaluation, management development and

succession planning, director compensation, board committees and annual board and committee performance evaluations. A copy of the Corporate Governance Guidelines is available on our website at ir.atricure.com under “Corporate Governance”.

Code of Conduct

AtriCure is committed to maintaining the highest standards of business conduct and ethics. Our Code of Conduct reflects our values and the business practices and principles of behavior that support this commitment. Our Code of Conduct is an integral part of our business conduct compliance program and embodies our commitment to conduct operations in accordance with the highest legal and ethical standards. In 2021, we updated our Code of Conduct to further demonstrate our commitment to ensuring it is relevant to our day-to-day work. The Code of Conduct applies to all of our officers, directors and employees. Each officer, director and employee receives training when onboarded and annually thereafter and is responsible for acknowledging, understanding and complying with the Code of Conduct. The Code of Conduct is supplemented by an additional Code of Ethics for the Chief Executive Officer and Senior Financial Officers. The Code of Ethics is applicable to our Chief Executive Officer, Chief Financial Officer and key finance employees with responsibility or authority for financial control, oversight or reporting matters. Each code is available on our website at ir.atricure.com under “Corporate Governance”. We will post any amendments to either code, as well as any waivers that are required to be disclosed by the rules of the SEC or Nasdaq,NASDAQ, on our website.